As an Independent insurance agent, we do the legwork for you. We are part of the largest alliance of Independent

agencies in the country and have access to over 20+ National Name Brand carriers. You do not need to search for hours looking for the best deals. We know which insurers offer specific coverage types and this allows us to personalize your coverage based on your specific needs. At The Good Insurance Group, we know the industry, understand policy language, and stay abreast on recent trends. We can simplify the buying process, provide expert, unbiased advice, and help you minimize your risk. Buying insurance based solely on price does not necessarily mean you are getting what you need.

Commercial insurance includes products such as commercial auto insurance, workers compensation insurance, federal flood insurance, health insurance and medical malpractice insurance. Commercial insurance protects businesses against potentially devastating financial losses caused by accidents, lawsuits, natural disasters, and other adverse events. Available coverage and premium costs vary by business type, size, and location.

|

|

|

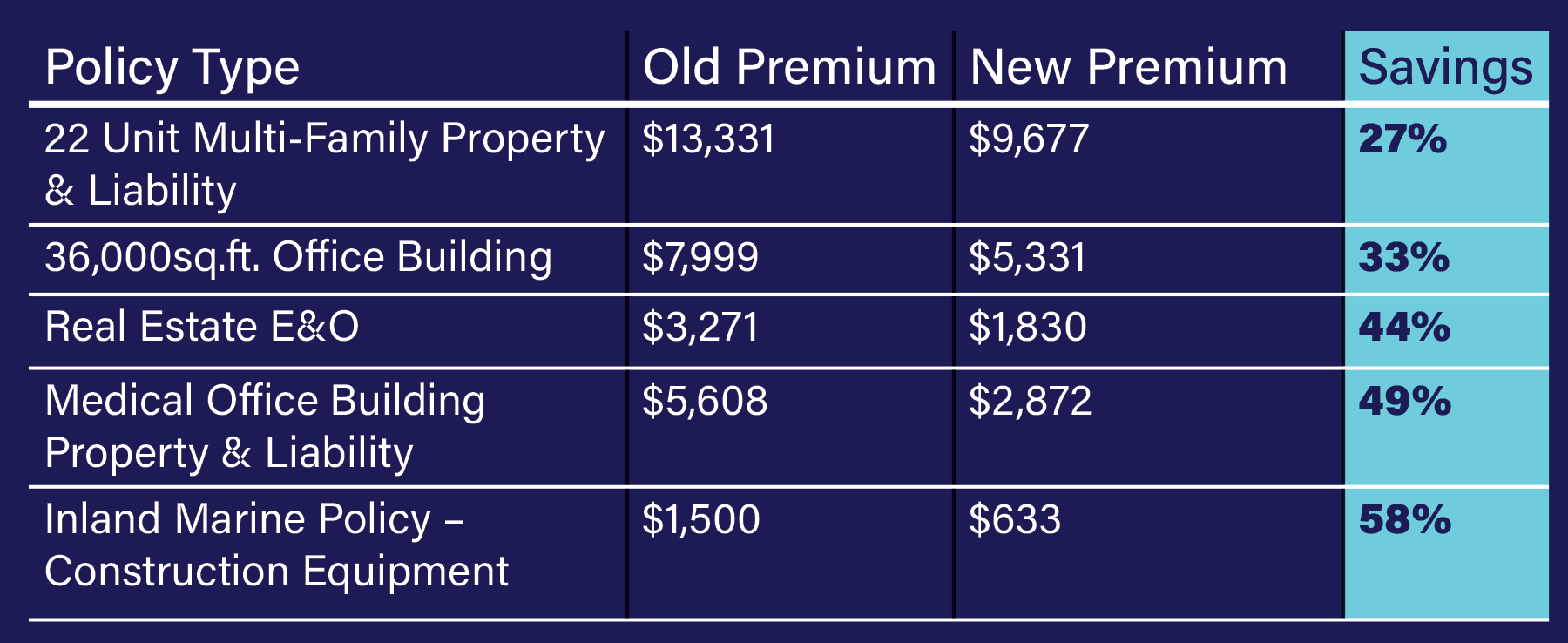

By getting you quotes from multiple companies such as Liberty Mutual, Travelers, Nationwide and many more we can give you multiple options so that you can make the best decision for your business.

When a catastrophic liability loss occurs, an umbrella insurance policy can mean the difference between a business surviving, or not. What happens if your business is sued and the judgment amount exceeds the liability limits of your primary insurance policy, or you have multiple claims and the limits are exhausted? Not having adequate coverage for lawsuits can leave your business exposed.

Commercial Umbrella Insurance provides an extra layer of liability protection by covering costs that go beyond your other liability coverage limits. Essentially, it complements your other liability coverages by taking over when your other liability coverage limits have been reached.

Each business is unique and the level of protection you need varies. Using our national insurance rater, we can find a business owner’s, builder’s risk, general liability, health insurance, or other policy that is custom-made for your business needs. By getting you quotes from multiple companies such as Liberty Mutual, Travelers, Nationwide and many more, we can give you multiple options so that you can make the best decision for your business. Contact the experts at The Good Insurance Group, LLC today for a free rate quote.

For any business, big or small, benefits serve as a crucial part of an employee’s decision to accept a new job, or to remain at one. From health care, to vacation time and life insurance, employees are looking for these added benefits to go along with their salary and are considering the entire benefits package before accepting employment at a new company. Offering a variety of benefits to employees helps employers attract and retain high-performing staff and avoid exorbitant expenses in the long run.

From cost effective rates to customized policies based upon your business’s individual needs, the financial specialists at The Good Insurance Group, LLC can help you find the perfect solution to attract and retain the best employees. Contact them today for a free quote.

.png)

The Good Insurance Group, LLC | Website Development by EZLynx® • Copyright © . All Rights Reserved.